In my conversations with CMOs and heads of product marketing, one issue invariably comes up. They are not happy with the quality of information they have on their competitors. In this post I will share the three frameworks I have used to successfully create, document and share competitive analysis with my clients – all three frameworks are needed to get a 360-degree perspective on your competition. The reason you need all three frameworks is because they provide competitive analysis at various levels of depth. The three frameworks are:

- At-a-glance view of all competitors (aka strategic grouping)

- A 5000-foot view of a competitor (aka SWOT analysis)

- A close-up 500-foot view of a competitor (aka 7 Ps model)

Let’s look at each framework in more details.

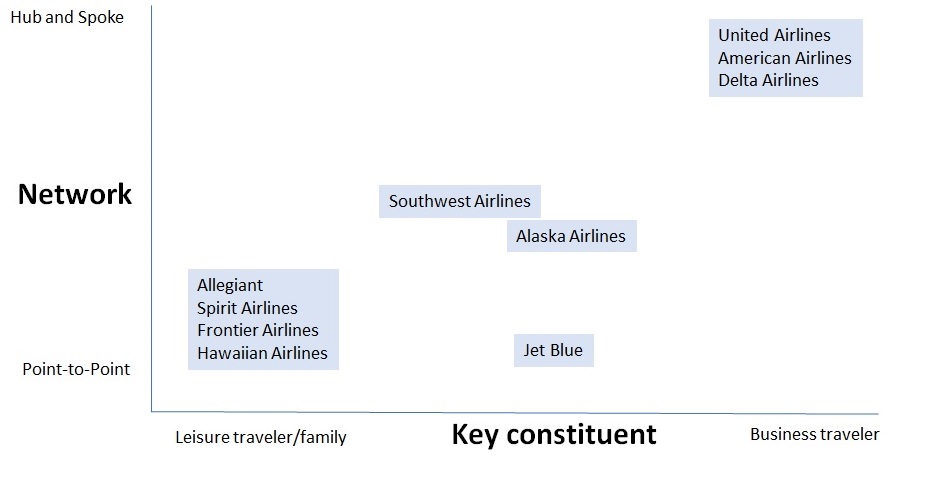

#1: At-a-glance view of all competitors in your space (aka strategic grouping):

Strategic grouping reveals the different competitive positions that rivals occupy in your segment. For example, see the chart below, where the two axes (network and traveler profile) give you a birds-eye-view of the various competitors in the US airline industry and how they compete along these dimensions. You can plot the strategic grouping chart in more than one way, each with different axes, to show how the various competitors stack up against each other along different dimensions. For example, the chart below can also be drawn along network and price as the two axes, to show how various airlines also compete along those two dimensions. Key is to choose the right axes for the analysis. The selected axes (i.e., dimensions) should be strategic drivers in your space – i.e., the various players make a conscious decision to complete along those dimensions.

#2: A 5000-foot view of a competitor (aka SWOT analysis)

In this framework, you take each competitor and do a SWOT analysis on them i.e.

- Competitor strengths: What competitor strengths pose a significant risk to your business? What are they doing better than you? What’s the difference between their strengths and your strengths?

- Competitor weaknesses: What are the weaknesses (of your competitors) that threaten their business? What are your competitors doing worse than you?

- Competitor opportunities: What opportunities does your competitor have to grow, change, offer new products/services, or establish new partnerships that could threaten your position?

- Competitor threats: What can shake up a competitor’s market position? Consider both internal and external factors. For example, are they easily affected by your shift to a SaaS only model?

As you can see this framework gives you a good handle on where your competitors are lagging you. You can leverage these insights to create a better product/GTM/pricing/partnership strategy and/or action plans to outperform rivals. Key is to come up with a very succinct SWOT analysis, at the right level of detail, to make it actionable.

#3: A close-up view of a competitor (aka 7 Ps model)

This is the 500-foot view about each competitor along these seven Ps:

- Product (including product strategy, key capabilities, and differentiated features)

- Pricing

- Promotion (i.e., marketing plans, latest campaigns, big events etc.)

- Place (i.e., their sales/product distribution model, how they go to market)

- Processes (strength or weaknesses in their end-to-end processes that matter competitively. For example, processes they use to build their product or sell their product, their customer success model etc.)

- People (stability and visibility of their management team, culture of the company etc.)

- Perception (how customers, partners or analysis perceive them)

In addition to capturing the analysis from the three frameworks in slide/document formats, the analysis can also be displayed in a consumer-reports style Harvey-balls comparison chart for quick consumption by various stakeholders. And of course, the competitive analysis feeds into the sales Battlecard and sales playbook.

The person doing your competitive analysis has to be constantly sourcing information to do the analysis and be updating this ‘living document’. Sources of information include: include competitor website content including messaging, whitepapers, customer success stories and announcements; competition’s webinars; their YouTube demos; articles in industry publications; analyst reports; information from your sales teams; trade shows, internal win-loss analysis etc. To me internal win-loss analysis, if done well, should be a huge source of information for competitive analysis. If you don’t have a person in your product marketing team who is assigned to competitive analysis at least 10 to 12 hours every week, then consider outsourcing it. Get a fractional consultant who has a good handle on (or can quickly come up to speed on) your technology, product capabilities, go-to-market, and the segment. Don’t hire a consultant who is not comfortable getting their fingers dirty at this level of detail.

I have successfully used this three-framework methodology in my past engagements to help clients build a very good understanding of their competition. If you found this post valuable, please feel free to share it with your colleagues and managers. Also, if you have any questions or feedback, you can message me at https://www.linkedin.com/in/applicationsmarketing/

Leave a comment