In the last blog post, I discussed the value of ‘white space analysis’ using your sales data history. We discussed how it can help you sharpen your customer marketing, improve your sales coverage model, and identify issues in your go-to-market strategy among other benefits. Today I will discuss how to leverage sales history data and CRM information to analyze the effectiveness of your vertical go-to-market strategy. You can use this analysis to identify key issues and take actionable steps to address them.

Segment performance analysis

Summarize your sales history for the past five years into ARR by new logos, ARR by expansion, and ARR from renewals for each industry sub-segment. I recommend doing this analysis at the industry sub-segment level, so you can see the details at an actionable level. For example, if one of your target segments is Life Sciences, look at your bookings performance by new logo. expansion and renewal by sub-segments such as Big Pharma, Pharma suppliers, Medical Devices, Biotech, CRO organizations, etc. It will help you identify who is your ideal customer sub-segment (where you are seeing success) so you can allocate the appropriate amount of marketing, sales and other resources towards that subsegment. Additionally, it identifies specific sub-segments that require a closer examination. This helps in understanding the reasons behind a less than expected success in a certain sub-segment or why your growth may be attributed to existing customers rather than acquiring new ones.

Segment penetration analysis

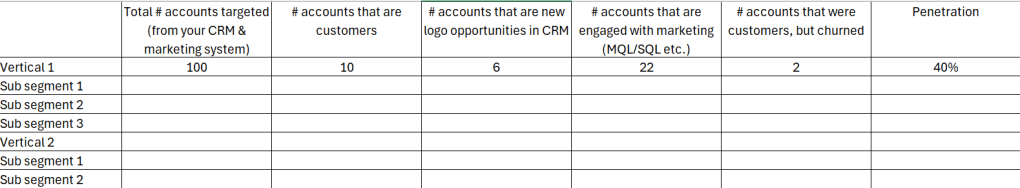

Combine your sales history data with CRM data to get a view into penetration by industry subsegment. Your data can tell you (for any sub-segment), the number of customers, the number of accounts that are opportunities in the CRM system, # of accounts that are MQLs in your marketing automation system, and the number of accounts that have churned. Adding these up and dividing by the number of accounts you are currently targeting in your CRM and marketing system gives you your high-level sub-segment penetration.

This analysis is a starting point to understand a) if you are targeting the right type of accounts in your CRM/marketing system (or if you are targeting some are too small/too large/too different than your ideal customer profile) b) where you have a high level of penetration and why? c) where you have a low level of penetration and why? This also is the starting point for creating a targeted action plan to increase penetration levels in certain sub-segments by

- Aligning sales/pre-sales coverage with your sub-segment opportunity

- Ensuring your marketing programs are aligned with your go-to-market. This is often the issue because marketing and sales may not be in lockstep – marketing is overinvesting in certain sub-segments, where penetration is already high (or that sub-segment is not as attractive) while under-investing in desirable segments.

- Ensure industry positioning and sales/marketing/demo materials are on message. This is often a huge gap at many clients I have worked with because your messaging may be too generic for some sub segments or it may speaking directly to the persona you are targeting in that sub-segment (mapping to their specific issues/needs and in their language).

- Improving referral/reference program, so you are leveraging your success in that sub-segment.

- Product gap analysis to identify capabilities that are impeding win rates. Combine it with win-loss and competitive analysis to get a 360-degree view.

If you need help with customer sales data analysis or with improving your vertical go-to-market/messaging, please reach out to me via LinkedIn.

Leave a comment